What is a Liquidity Event? Planning Your Startup Exit Strategy

Share options mean a lot for investors, founders and employees. But without liquidity events, shareholders can’t unlock or use any of the capital they own. They can’t, for instance, use their share options to buy a house. Or a horse. Or even a cup of coffee.

In a nutshell, liquidity events are when the capital locked up within growing private companies is released. They’re seen as major milestones, but they can be pretty complicated endeavors. Shareholder groups benefit in different ways — and in a different order — when liquidity events happen.

Truthfully, liquidity events deserve to hold space in your brain no matter where you are on the startup journey — whether you’re riding on a unicorn, galloping toward an IPO, or considering a Series B financing round.

We’ll begin this article with a simple definition of liquidity events. Then, we’ll go into the nitty gritty of each type of liquidity event — and we’ll touch on ways to release some (but not all) of your equity.

What is a liquidity event?

Simply put, liquidity events allow shareholders to realize the value they’ve created in real money. Liquidity events convert illiquid shares into liquid assets — in other words, cash.

Usually, liquidity events represent the proverbial “pot of gold” at the end of a rainbow. Early investors (founders, angels and early venture capitalists, for instance) stand to make a lot of money when liquidity events go well — IPOs in particular can generate an enormous amount of capital.

Forms of liquidity event

When liquidity events occur, shareholders cash out their interests, either in part or in full. There are numerous different types of liquidity event, which we’ll explore next.

1: Mergers and acquisitions

A merger happens when one business buys another business and both companies fuse to form a new, larger company. An acquisition takes place when one business – or private equity firm – buys up a majority of the , rather than creating a combined enterprise.

The acquirer can offer cash, stock, or a mix of both to fund the deal:

- All-stock merger or acquisition: Company shares become the exchange currency. When companies merge or are acquired, shareholders receive identical stock options in the new company to the ones they held before the merger or acquisition.

- All-cash merger or acquisition: Company shares are sold for cash. When companies experience this type of liquidity event, current shareholders receive a pre-agreed amount of money for each share they hold.

- Combination stock/cash merger or acquisition: The majority of a company’s shares are sold for cash. With a majority stake, the business’s new owners have control. Shareholders receive a payout, but some individuals also keep stocks.

2: Initial public offerings

If you decide to float your company on the stock market via an initial public offering (IPO), you and your fellow shareholders can sell your shares on the stock market.

When IPOs go well, they can raise a lot of cash. But going public can take months. The journey begins with backing from one or more underwriting firms — usually investment banks — which provide capital to fund the IPO.

Your underwriting firm will work with you to establish your initial offering price and company valuation. You'll also embark on a 'roadshow' – an extensive round of pitches to other banks and institutional funds designed to gauge appetite for your forthcoming stock issuance.

You’ll also need to decide which stock exchanges to list your company on. The US is the largest and most liquid stock market, and exchanges like the Nasdaq are extremely well-versed in understanding the growth trajectories of younger, rapidly growing businesses. But if you have strong ties to another market, it may make more sense to list closer to home. Two European stock exchanges with particular experience in tech listings are the London Stock Exchange (which hosted Darktrace and Deliveroo's IPOs last year) and Amsterdam's Euronext, where global public stocks like Adyen are listed.

Is an IPO the way to go?

The advantages of IPOs are obvious, but are there disadvantages associated with going public? In a word, yes.

Public companies have to share a lot of information with shareholders and with regulatory bodies. Financial reporting and disclosure requirements step up a gear, with significant new regulatory and administrative processes that may consume bandwidth internally.

Founders and other insiders are often temporarily bound by post-IPO lock-up periods, which can last between 180 days and two years (sometimes more). Lock-up periods are normally designed to prevent leaders and management team members from taking their cash and swiftly departing.

Additionally, many founders feel a loss of autonomy after they take their 'babies' public. IPOs may remove much of the company founder’s previous control, and efforts from founders to hang on to 'golden shares' and retain more control can be viewed with some scepticism by investors.

3: Bankruptcy / insolvency

While many liquidity events are seen as positive milestones, the other side of the coin is real too. Bankruptcy, or liquidation, is closely linked to insolvency, which effectively means a company can no longer honor its obligations to its creditors.

When businesses go bankrupt, business owners and other shareholders (particularly founders and employees) frequently end up with nothing. If a small amount of capital does remain after debt repayments, shareholders are repaid in order of preference, with external investors taking priority. (For more on preferred shares, read our blog on startup fundraising.)

What about secondary share sales?

Even though most liquidity events come in the form of M&A activity or a public listing, shareholders can on occasion turn their shares into cash earlier with secondary share sales also known as secondaries.

Occasionally, startups and their investors will allow founders and (more rarely) employees to sell a proportion of the stock they hold to investors, usually to reward long-serving employees who may have been earning salaries lower than standard market rates. More secondary markets now exist to help companies administrate this process.

Who benefits from a liquidity event first?

Share classes start to matter when liquidity events happen. Investors with preferred shares – such as angel investors and venture capital firms – will see returns first, before founders and employees with common stock. (If you have a tax-efficient employee share option plan (ESOP) for employees, such as an EMI scheme in the UK, employees can benefit from a lower tax burden when they sell shares.)

Venture capital firms, for instance, often request liquidation preferences – this might be, for example, “2x, non participating.” In a liquidity event where this clause is relevant, preferred stakeholders would receive at least twice their invested capital before other shareholders are paid out.

As we mentioned a little earlier, lock-up clauses might mean that investors (particularly insiders) don’t see cash on the day of an IPO or a merger. Founders, for instance, might have their shares tied up for a couple of years so that they can’t “run away” and leave their companies leaderless.

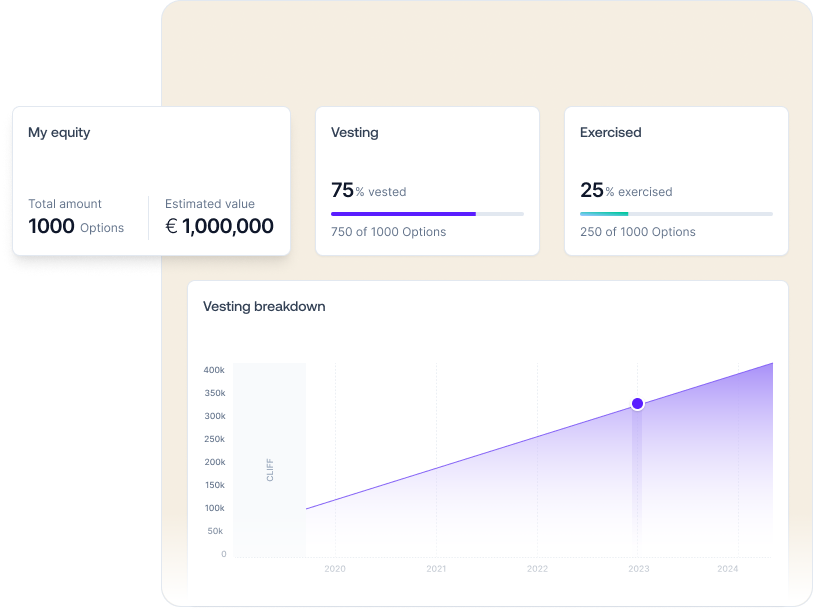

In any scenario, it is important that for employees that hold equity (vested or unvested) should be able to track value, manage exercising and model exit values. In Ledgy, our employee dashboard enables teams and individuals to better understand their equity position and action important steps when they arise. For example, as a new started you are able to evaluate the value of your equity and vesting schedule. Or if you would like to exercise vested option, you can do so in Ledgy. Most importantly, if you would like to estimate future company valuations to assess what your equity could be worth in future, you can do so in your dashboard. All of these Ledgy features exist to help improve employees understanding and levels of control regrading their equity compensation.

Learn about our online cap table management software for large enterprises.

Prepare for liquidity events with Ledgy

Winners keep score — and that’s especially true when it comes to liquidity events. If you know where you are now, you can prepare to liquidate your assets (or some of your assets) in a favorable way at a later date. You’ll also know when to initiate a liquidity event.

Ledgy’s equity management platform can help you extract in-depth insights from your cap table. You can share information and documentation with underwriting firms, venture capitalists and other investors in moments. Ledgy can also help you communicate effectively with all your stakeholders, including your employees, as you prepare for a liquidity event.

To learn more about what Ledgy can do for you, contact us today.

Stay up to date! 🎉

Subscribe to our newsletter and receive the latest insights on the equity world

Automate your Equity Planning

Use Ledgy for bulk document creation and digital signature facilities for all international grant types in a centralised platform.

Find out how

.png)