Equity Management 101: What You Need to Know

Signing your share option agreement, or turning your share options into shares, are exciting moments for anyone working in a startup. Equity compensation is becoming core to attracting and retaining talent in early-stage companies. But behind every equity contract and new option grant, there's admin work for someone in the company – usually in the finance, operations and/or people teams.

Things are changing, though. Equity management software is redefining equity management from the ground up, automating more and more processes for businesses and saving time across finance, people, HR and legal teams. This is your guide to the different processes and procedures that go into running an equity management program in a scaling company.

What is equity management?

{{quote-1}}

What are the most important equity management processes?

Equity management involves a range of different tasks. Some are near-daily duties, while other tasks might only come around once a year. To make matters still more complex, different equity management tasks might be 'owned' by one of a number of different teams around the company.

As we'll see, your choice of equity system could play a key role in determining how much time and effort is sunk into these different procedures.

Granting share options

At the core of any equity management program is distributing new equity grants to the team. And it's a great part of the job for equity administrators! You get to play Santa, giving out ownership and opportunity to team members.

When the company issues employee stock options, key details to get right are the grant owner's name, the number of share options they'll receive, the date of the grant, the strike price at which they'll be able to convert their options into shares, the date on which the options expire (if applicable), the vesting schedule for the grants, and more.

Unsurprisingly, doing this manually for a large number of team members takes a significant amount of time for the internal process owner.

On Ledgy, you can create new grants natively on the platform or import existing grants from a spreadsheet. Here's a step-by-step guide.

Cap table management

Cap tables are deceptively tricky to manage. As companies become more complex, different share classes and preferences have a big impact on who gets what when a liquidity event – like a sale or public listing – takes place.

It's often the responsibility of a co-founder or the most senior finance stakeholder to manage the cap table. This includes carrying out complex scenario modeling exercises to anticipate income distribution in the event of an exit. With equity management software, it's easy to immediately see the permutations of different cap table models.

Online cap table management software for large enterprises

Investor / shareholder communications

With many companies regrettably making layoffs and refocusing on efficiency in recent months, it's vital to keep everyone connected with progress. Good equity management and good shareholder management go hand in hand.

Equity software can also give a boost to investor relations. On an equity management platform like Ledgy, equity managers can choose to communicate with specific sub-groups of stakeholders as well as send mass communications to everyone, sharing information and documentation in seconds. And institutional investors dealing with portfolio management will appreciate simpler communications.

Maintaining compliance

When setting up and scaling an equity plan, it's easy to forget about the small details that minimise risk and help keep teams aligned. If private companies are running a tax-efficient employee stock option plan, for instance, they are likely to have annual financial reporting deadlines to the tax authority. Getting regular company valuations is another recurring requirement.

And human error leads to business risk too. A 2022 Ledgy survey found that data entry errors are the most common type of mistake made in finance teams, with 60% of businesses having made a spreadsheet error that cost the business money. Equity management software helps flag errors before they can harm the business.

Learn about our financial reporting software here.

Onboarding and offboarding employees

It's always nice to make a good first impression. Companies that integrate equity grants into the onboarding process give new hires a smooth start. But as well as onboarding, teams around the business also need to complete important procedures when people leave the business.

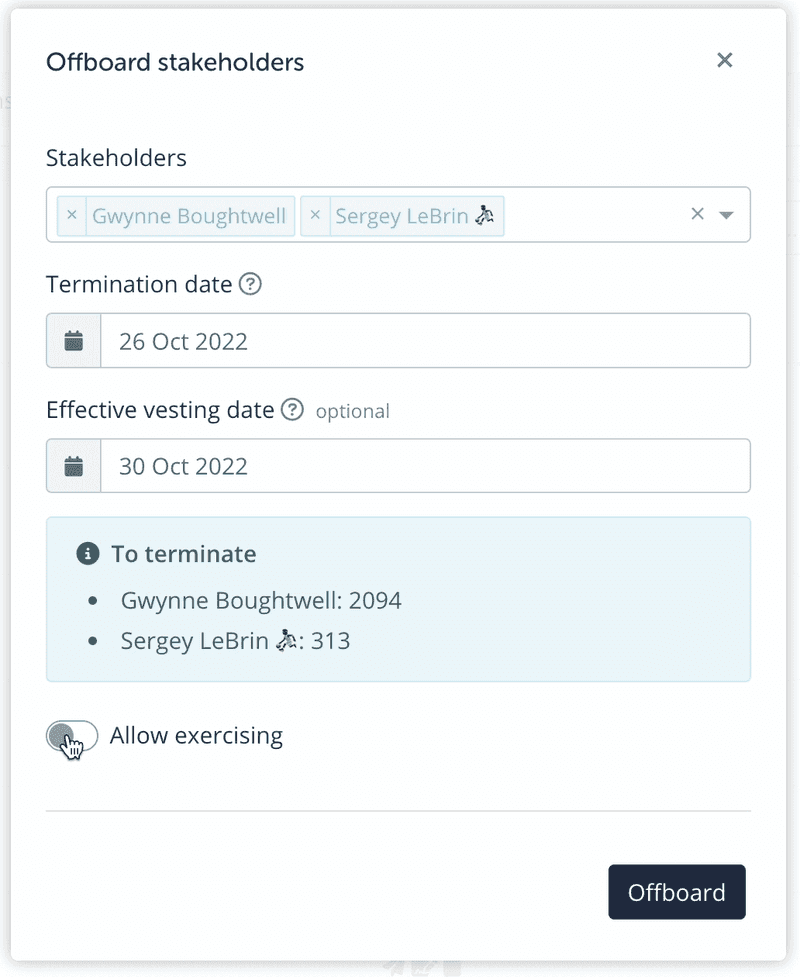

In some ways, offboarding employees can actually be more complex than onboarding, as redundancies might trigger vesting accelerations and exercise windows. These will then need to be reflected in equity management software. Ledgy's offboarding workflows help make sure you can treat people leaving the business fairly.

Handling documentation

Contracts are a business necessity, and when it comes to managing equity, contracts give companies and employees reassurance and security. But for internal teams, getting dozens – maybe hundreds – of contracts shared, signed and stored is a nightmare.

When your central system for equity is a spreadsheet, document management can get very messy very quickly. Equity management software like Ledgy allows contracts to be dealt with in seconds, speeding up processes for finance, operations, people and legal teams. And to make things even easier, Ledgy attaches all documentation to the relevant grants, so when you need to dig out a piece of information, it's right there when you need it.

Equity management for international teams

Increasingly, companies are looking internationally at an early stage. More teams than ever are distributed across multiple markets. So what does this mean for people managing equity in a company with international employees?

Prepare for increased tax and compliance complexity

There’s no question that freeing up executives to adopt a global perspective when hiring can add huge value to teams. But there is an increased regulatory burden too. Companies hiring in new markets must understand where processes will need to be adapted. Employment contracts might need to be updated. Attitudes towards data security and privacy best practices – such as GDPR, Schrems II or SOC 2 Type 2 – may vary from market to market. And, of course, you may have to approach share options and employee ownership differently.

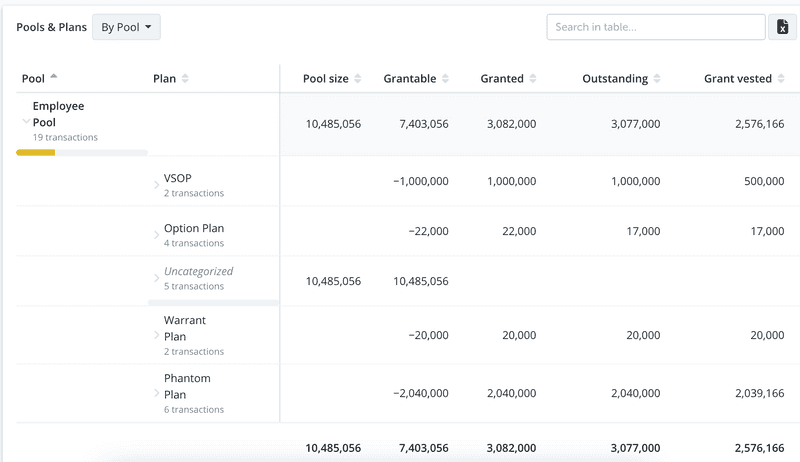

Unfortunately, there is no such thing as a ‘one size fits all’ share plan that works around the world. A British business expanding into Germany cannot just offer its new employees the same EMI options that work in the UK, for example. That's why we recommend setting up a top-level employee option pool in your equity management platform, which can be split out into different share plans, catering for different geographies or types of share option grant, as below:

Keep things fair: align on a benchmarking strategy

It's vital to ensure equity allocations are fairly done. Otherwise, employees may become disgruntled and unsatisfied if they feel like they are not being adequately rewarded for their efforts.

Often, companies opt to distribute equity based on a salary multiplier, such as 0.5x of base salary. With this model, an employee earning €100k would be awarded an equity package worth €50k. Multipliers are often different based on job roles: a technical employee in product or engineering might receive a multiplier of 0.6x, while the multiplier for non-technical employees might be 0.4x.

Many companies use benchmarking tools like Pave to get accurate geo-specific data for their equity benchmarks. It's worth remembering that equity norms vary significantly across markets: the expectations of an employee joining in San Francisco may be quite different to someone joining into a similar role in Berlin. Make sure you can clearly explain the logic behind your equity benchmarking strategy to the team.

Create resources for the team

Do you have resources on hand to explain more technical equity management terminology? Could you create ‘worst-case’, ‘average’ and ‘best-case’ scenarios to give your team more context as to how the value of their options may change over time?

When people understand how the value of their equity stakes change over time, they feel more engaged and can take more ownership over their roles at work. This is particularly true in companies with remote employees, where it becomes even more important to use the common interests of every team member, no matter where they're based.

To get started managing equity in your remote or international team, dive in to Ledgy’s guide to explaining employee participation plans to employees.

Equity management: software or spreadsheets?

Years ago, equity and cap table management was exclusively done using spreadsheets. But with equity management software now seen as central to performant finance, operations, people and legal functions, companies must choose how and when to migrate away from spreadsheets.

If your company is weighing up this decision, here are a few factors to consider.

Think beyond the finance team

Your finance team might be familiar with complex spreadsheet modeling. But equity management doesn't just live in the finance team: it's likely that HR, people, legal and operations teams will regularly need to get closely involved with equity admin.

Instead, equity management software like Ledgy has been designed to be easy to handle for all equity administrators, whatever team they're from and whether or not they're Excel experts.

Bring your employees with you

Navigating employee stock-based compensation is never easy for companies. That's why being able to showcase the details of individuals' equity stakes delivers a real difference to engagement and internal understanding.

The impact of a cloud-based solution like Ledgy can be transformative for employee engagement. Here's what John Fraser, Finance Director at AI-driven software company Peak, has to say:

{{quote-2}}

Equity management software gives employees access to their own dashboards, and on Ledgy employees are empowered to play with different company-approved models that make it easy to see what might happen to their ownership stakes in pessimistic, 'base case' and optimistic scenarios. This creates a greater sense of ownership and makes equity 'real' for the team.

Equity management made easy with Ledgy

Equity compensation for employees is already critical for early-stage private tech companies. And as more companies decide to democratise company ownership and distribute share options to the team, the demands on finance, people, operations and legal teams are increasing.

Understanding the different components of a well-run equity plan can transform workflows in teams around the business, unlocking value and driving cultural alignment.

Today, more than 2,500 scaling companies around the world choose Ledgy as their equity management solution. By automating equity processes, teams can get time back to focus on high-value strategic work.

FAQs

1. How do equity management tools handle contract signatures?

Different equity management platforms are able to integrate signatures into contract workflows. Ledgy offers native e-signatures as well as an integration with DocuSign, the leading e-signature tool. Ledgy customers using DocuSign have access to witnessed contracts, which are essential for many legal and financial agreements in different markets.

2. Why do so many internal stakeholders need to have access to equity software?

A company's equity plan naturally sits at the intersection of different teams. It's a financial issue, for sure, but it's also highly relevant to people and culture. Meanwhile, the number of processes involved in running an employee equity plan means that the operations team may look to get involved.

We offer Enterprise customers custom access level control, to help teams keep data secure by making sure different equity admins can only see what they're allowed to see.

Learn about employee stock option plan's here.

Stay up to date! 🎉

Subscribe to our newsletter and receive the latest insights on the equity world

Automate your Equity Planning

Use Ledgy for bulk document creation and digital signature facilities for all international grant types in a centralised platform.

Find out how